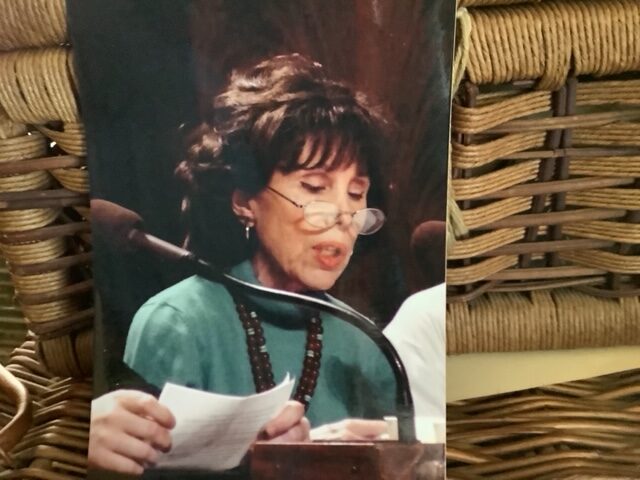

Linda Stewart is a screenwriter, novelist, reviewer, and—above all—an independent contractor. Throughout her career, she’s written magazine articles and book reviews for publications like the Washington Post and Chicago Tribune. She’s penned television programs, optioned multiple screenplays, and even written several novels.

All of this has been freelance work, which she started doing on the side while working full-time at an advertising agency in New York.

But at 34 years old, Stewart said she decided to “just take a flyer on myself, figuring I could earn enough on my own to support myself for a year,” she told IW Features, explaining how she transitioned her side freelance work into a full-time gig. “If it didn’t work out, in a year, I could go back.”

She never looked back.

“I like to be my own boss. I like to set my own work hours. I like to be able to travel and vacation when I want to and for as long as I want to. I like to do different things (and learn how to do different things),” Stewart said, emphasizing the flexibility she sought as an independent contractor.

But the threat of losing her health insurance coverage loomed over her newfound flexibility.

Under current federal and state labor laws, companies cannot offer benefits such as health insurance coverage to independent contractors without being forced to reclassify those workers as employees, in turn stripping freelancers of their flexibility. For companies, reclassifying an independent contractor as an employee can mean expensive penalties and 20-30% higher costs.

“There is no way I would have wanted to be covered by [freelance clients] as an ‘employee,’ nor would they have wanted to cover me,” Stewart explained. “Nor would I have had coverage between projects and gigs.”

Indeed, Stewart knows firsthand the drawbacks of being forced into an employer-sponsored healthcare plan.

“In an early staff job for an ad agency, I was forced to drop [my own plan] and take the agency’s policy instead,” she said. “It was way more expensive, and the premiums were deducted from payroll.”

Reapplying again for her previous policy when she began freelancing full time was complicated, Stewart said. She explained that the company was reluctant to cover her again because she’d gotten sick from eating bad seafood. For a brief time, she said she was even left without coverage.

Fortunately, she was able to regain her old policy through Blue Cross Blue Shield. While the policy had its drawbacks, she said it suited her needs better than the employer-sponsored plan, covering 100% of catastrophic events and 80% of necessary diagnostics.

“It left me free to choose to consult any doctor I wanted to see, and that freedom is very important,” she added.

However, unlike with an employer-sponsored plan, Stewart had to pay for her coverage completely out of pocket without the resources of a larger organization to fund and negotiate the policy. And she recognizes that the landscape for freelancers today can prove even more challenging.

“By Obamacare time [in 2010], I had luckily graduated into Medicare, also with a non-HMO [health maintenance organization] supplement that’s no longer available but was grandfathered in,” she said. “Luckily, I dodged the bullets of the never-implemented Hillarycare, which would have forced me into the limitations of a dreaded HMO and with a much more expensive premium.”

Indeed, the average marketplace plan today can cost individuals more than 500% out of pocket compared to the employee portion of an employer-sponsored plan. For families, even subsidized, moderate-coverage plans can easily cost over $500 each month.

It’s why Stewart said she believes that a portable solution is the best policy to provide freelancers with affordable workplace benefits while protecting their flexibility.

“A personal portable insurance policy is the only solution for freelancers,” she said.

With portable benefits, independent contractors would have the freedom to choose their own benefit policies and have their clients contribute to the plans. It would also protect these workers’ status as independent contractors and not force them into unwanted employer-employee relationships simply because a client contributes to their benefits.

But beyond the legal landscape, these policies could provide real-world relief to independent contractors. To Stewart, portable benefits would have meant “everything,” she said.

Still, despite these challenges, Stewert reflected positively on her successful career as a freelancer.

“Going freelance was the best decision I ever made and gave me the most rewarding and varied work life I could have had,” she said.

The opening paragraph of this article was corrected to reflect Stewart’s novel writing.